Financial Transparency

Marshall ISD is dedicated to providing our stakeholders with clear, concise financial

information. The Business & Financial Services department is committed to excellent

stewardship of our resources. Part of our pledge is ensuring that we are financially

transparent to our community.

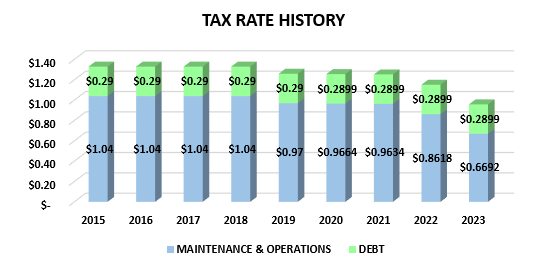

This chart depicts the tax rates for the past nine years, per $100 of property value.

Due to HB3, tax payers benefited from property tax relief.

FULL-TIME EQUIVALENT EMPLOYEES | ||

|---|---|---|

TOTAL | STUDENT TO STAFF | |

RATIO | ||

TEACHERS | 334.5 | 15.1 |

PROFESSIONAL SUPPORT | 87.3 | 57.8 |

ADMINISTRATORS | 33.9 | 148.9 |

EDUCATIONAL AIDES | 113.7 | 44.4 |

AUXILIARY STAFF | 156.8 | 32.2 |

TOTAL FULL-TIME EQUIVALENT EMPLOYEES | 726.2 | 7.0 |

Source: 2021-2022Texas Academic Performance Report | ||

Annual Financial Review

Proposed Budgets

Raw Format Budget

FIRST Reports

Adopted Budgets

Check Registers

State of Revenues, Expenditures, and Changes in Fund Balance

Payroll Registers

Utility Expenditures

PEIMS

Public Information

PLEASE CONTACT DARBI HILL FOR OPEN RECORDS REQUESTS

Darbi Hill

Director of Communications, Public Relations, & Marketing

P O Box 43

Marshall, TX 75670

(903)927-8727 communications@marshallisd.com

hillde@marshallisd.com

FOR MORE INFORMATION ON OPEN RECORDS PLEASE VISIT: Open Records/Texas Public Information Act

Board Member Contact Information

Brad Burris brad.burris@marshallisd.com

Cathy Marshall cathy.marshall@marshallisd.com

Chase Palmer chase.palmer@marshallisd.com

Lee Lewis lee.lewis@marshallisd.com

Rudy Medina rudy.medina@marshallisd.com

Ted Huffhines ted.huffhines@marshallisd.com

Bettye Fisher bettye.fisher@marshallisd.com